The 2-Minute Rule for Estate Planning Attorney

The 2-Minute Rule for Estate Planning Attorney

Blog Article

Estate Planning Attorney for Beginners

Table of ContentsUnknown Facts About Estate Planning AttorneyThe 20-Second Trick For Estate Planning AttorneyThe Definitive Guide for Estate Planning AttorneySome Known Factual Statements About Estate Planning Attorney

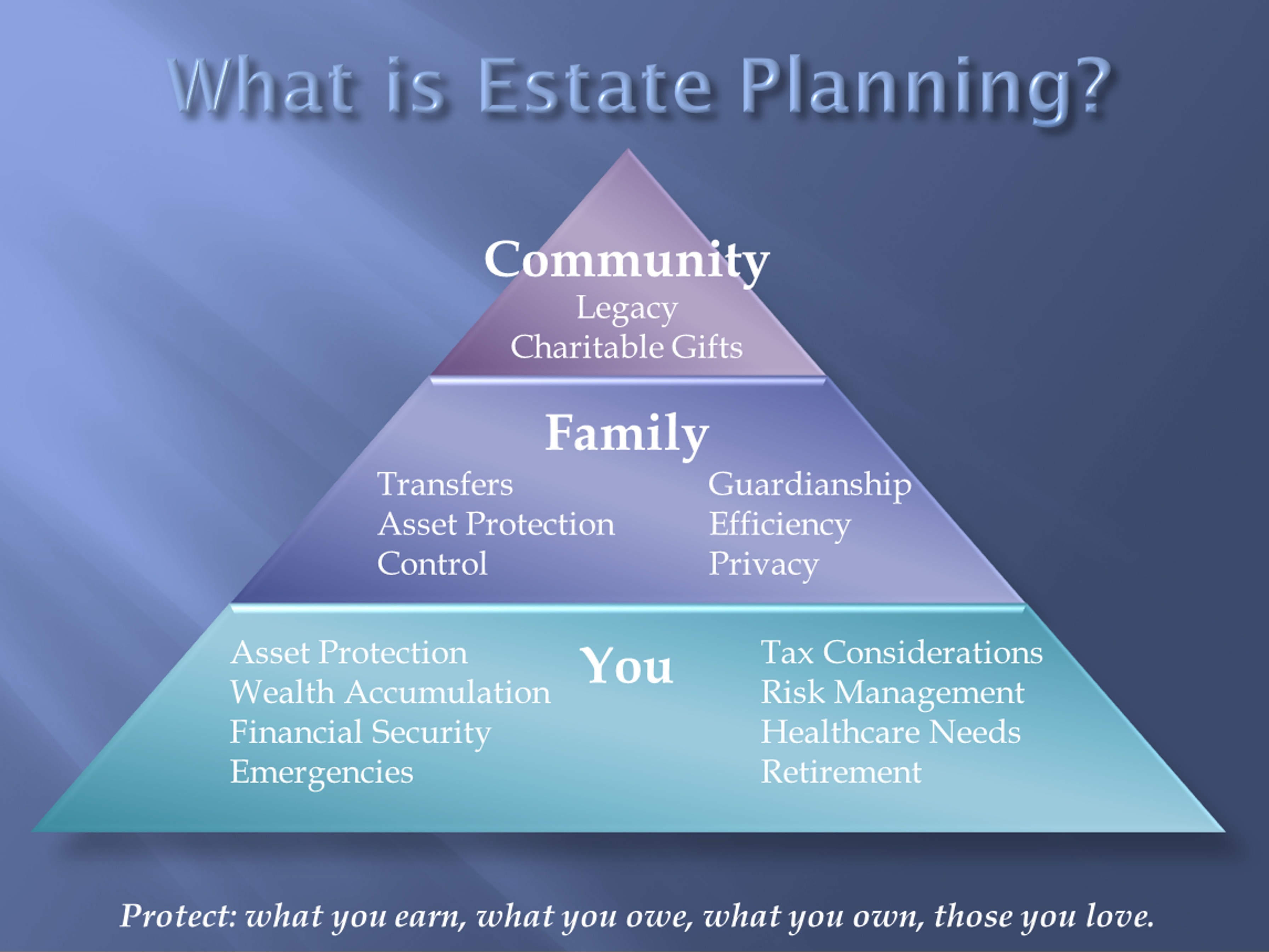

Estate preparation has to do with ensuring your household recognizes exactly how you desire your assets and events to be taken care of in the occasion of your fatality or incapacitation. However beginning the procedure can typically appear frustrating. That's where estate planning attorneys been available in. These specialists guide you through the ins and outs to assist make certain your desires will be complied with.

It's important to function with a lawyer or law company experienced in estate regulation, state and government tax obligation preparation, and depend on administration. Or else, your estate strategy might have spaces or oversights.

Download and install electronic files to the cloud and check hard duplicates so if anything goes missing, you have a backup within your reaches. Having conversations with the individuals you like concerning your very own passing away can really feel uncomfortable. It's a major topic and there's a lot to discuss. Nonetheless, the structure of your estate strategy begins by analyzing these tough situations.

5 Easy Facts About Estate Planning Attorney Shown

Whether you're just starting the estate planning procedure or intend to revise an existing strategy, an estate planning lawyer can be a very useful resource. Estate Planning Attorney. You might think about asking pals and colleagues for referrals. Nevertheless, you can additionally ask your employer if they offer legal strategy benefits, which can aid link you with a network of experienced lawyers for your lawful requirements, consisting of estate planning.

Estate planning attorneys are practical during the estate preparation process and later on via the procedure of probate court. They recognize the state and federal visit this site regulations that will certainly impact your estate.

Estate Planning Attorney Fundamentals Explained

A great estate planning lawyer may be able to aid you avoid probate court completely, however that largely depends on the kind of assets in the deceased's estate and just how they are lawfully allowed to be transferred. In the event that a recipient (or perhaps a specific not assigned as a recipient) reveals that she or he prepares to contest the will and take legal action against the view estate of a dead relative or enjoyed one that you additionally stand to profit from, it could be in your ideal passion to consult an estate preparation lawyer promptly.

Normal lawyer really feels frequently range from $250 - $350/hour, according to NOLO.1 The a lot more difficult your estate, the more it will cost to set up., go to the Safety Knowing.

7 Easy Facts About Estate Planning Attorney Shown

They will advise you on the most effective legal choices and papers to shield your assets. A living count on is a legal paper that can resolve your desires while you're still active. If you have a living trust fund, you can bestow your assets to your loved ones during your lifetime; they just don't get access to it until you pass.

For instance, you may have a Living Count on prepared during your lifetime that gives $100,000 to your daughter, yet just if she finishes from university. There are some papers that go right into effect after your death (EX: Last Will and Testament), and others that you can make use of for clever property management while you are still alive (EX-SPOUSE: wellness treatment directives).

As opposed to leaving your relative to presume (or say), you need to make your purposes clear currently by collaborating with an estate planning lawyer. Your attorney will certainly assist you draft health care regulations and powers of attorney that fit your way of life, possessions, and future goals. Website One of the most typical method of avoiding probate and inheritance tax is with the use of Trust funds.

If you meticulously intend your estate now, you might be able to stop your beneficiaries from being forced right into lengthy legal fights, the court system, and adversarial family disagreements. You desire your heirs to have a very easy time with planning and lawful issues after your fatality. A correctly executed collection of estate plans will certainly conserve your household time, money, and a good deal of stress.

Report this page